property tax on leased car in ky

While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Vehicle has a.

Free Property Turnover Sheet Printable Real Estate Document Real Estate Forms Free Printable Letters Free Property

The terms of the lease will decide the responsible party for personal property taxes.

. In Kentucky since IFS is the legal owner of the vehicle the tax bill is paid immediately upon receipt. This page describes the taxability of. The PVA requires proper documentation from the taxpayer before exonerating or refunding any tax.

Depending on where you live you pay a percentage of the cars assessed value a price set by. The fee amount ranges from. In addition to taxes car.

There residents pay an effective rate of 405 meaning an annual bill of 1011. The Internal Revenue Service requires that these deductible. Motor Vehicle Usage Tax.

4 Reciprocity shall apply to any tax due Kentucky on lease or rental receipts only if the re-ciprocal. The vehicles renewed must have unexpired registrations. KRS 1348055b The notice of taxes payable informs the person of the amount of property tax still due on the vehicle.

A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. For vehicles that are being rented or leased see see taxation of leases and rentals.

Vehicle value includes options which customers vehicle does not contain. However the state has an effective vehicle tax rate of 26. How much are taxes on a car in KY.

Tally your car lease costs. In the case of new vehicles the retail price is the total. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

Kentucky provides two methods for paying taxes on leased vehicles. If you have assessment questions regarding motor vehicles or boats please. Registering a Vehicle the First Time.

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles. The rate is also determined by the local municipalities so it varies from one area to another according to the state.

Arkansas Connecticut Kentucky Massachusetts Missouri North. Payment shall be made to the motor vehicle owners County Clerk. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all.

Processing Fees Payment Methods. Every year Kentucky taxpayers pay the price for driving a car in Kentucky. Vehicle has been wrecked and damage has not been repaired prior to assessment date January 1.

Kentucky provides two methods for paying taxes on leased vehicles. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Your estimated IRS mileage deduction is 34500 over the course of your lease. The first fee is the fee when you first register your vehicle at the clerks office under the U-Drive-It program. 3 Kentucky shall tax any excess lease or rentals relating to the lump-sum tax amounts.

Processing Fees and Payment Methods. It is based on the month of incorporation for the. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles.

There are two U-Drive-It fees. A car lease acquisition cost is a fee charged by the lessor to set up the lease. The tax can be paid in full when the vehicle is registered at the County Clerk or the owner can contact the Kentucky.

The non-refundable online renewal service fee is a percentage of the transaction. It is levied at 6 percent and. To discuss additional details regarding the property tax bill please.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred. Please allow 5-7 working days for online renewals to be processed. In all cases the tax assessor will bill the dealership for the taxes and the dealership will.

Add up all the costs associated with your leased car.

Who Pays The Personal Property Tax On A Leased Car

7 On Your Side How To Avoid Car Lease Buy Out Rip Offs Abc7 New York

Lease To Ownership Madison County Clerk S Office

Expat Car Leasing Finance And Rental

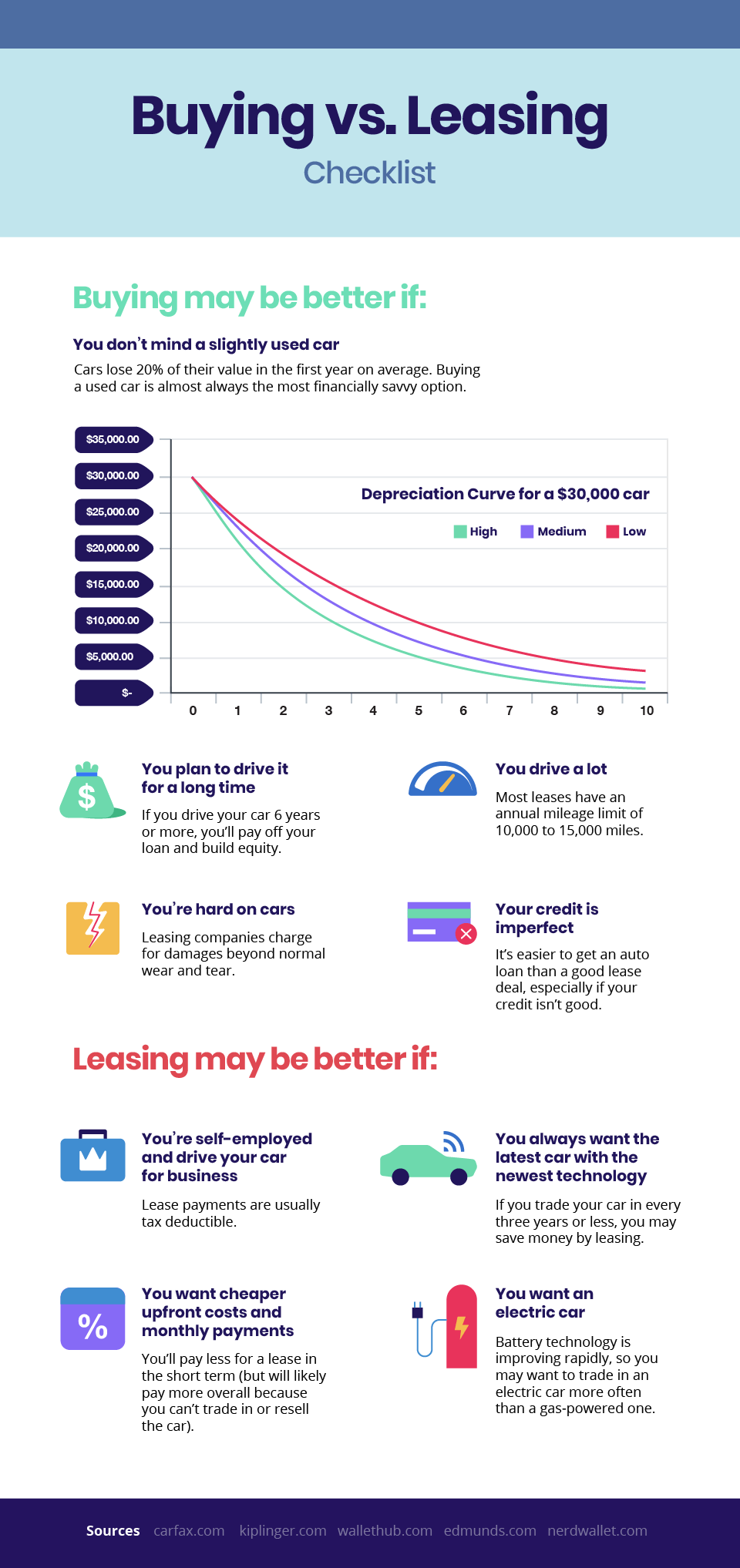

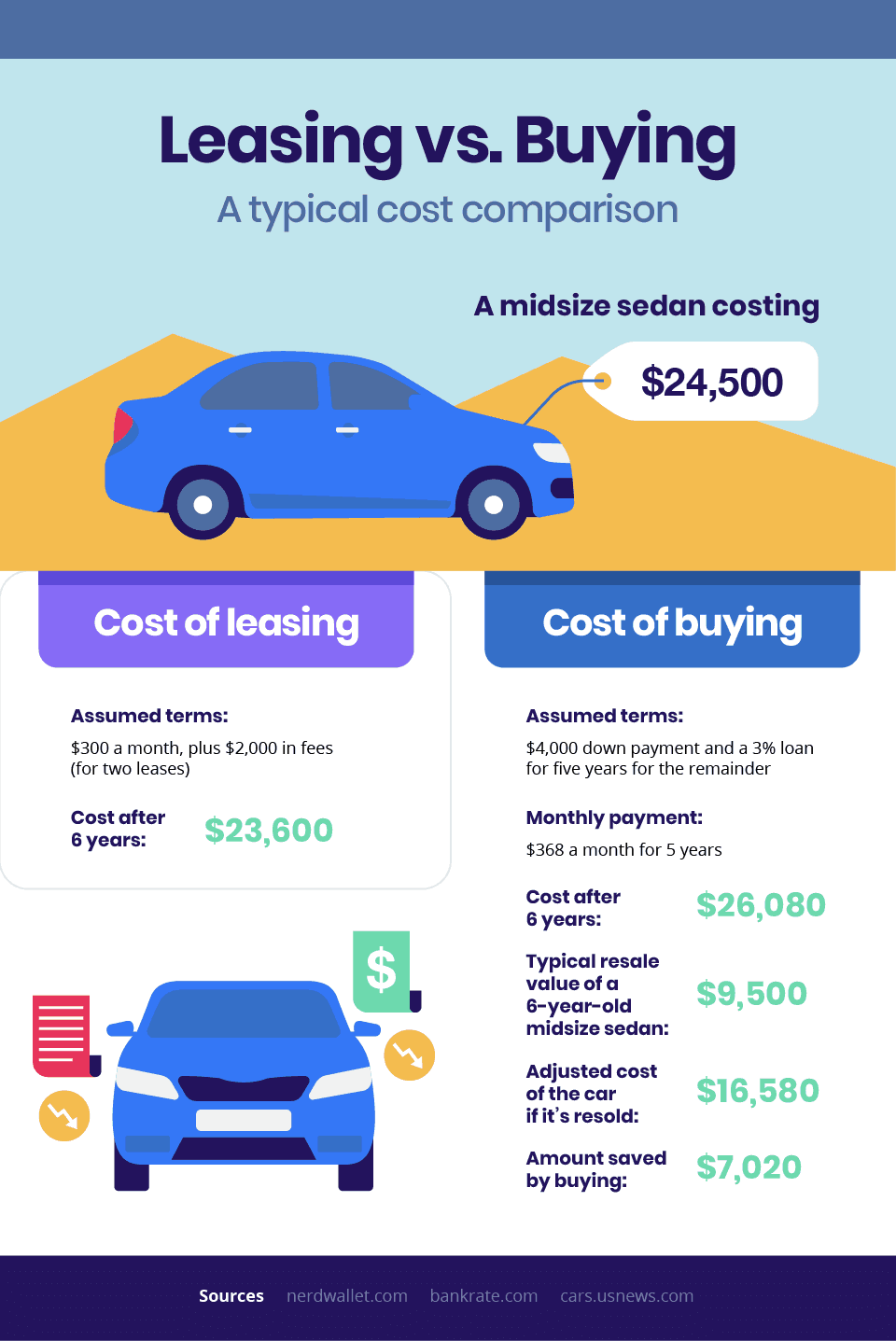

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

What Happens If You Total A Leased Car Answered

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

What Is Residual Value When You Lease A Car Credit Karma

Who Pays The Personal Property Tax On A Leased Car

Why You Should Buy Your Leased Car Forbes Wheels

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Lease To Ownership Madison County Clerk S Office

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog