nc sales tax on non food items

North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. Sales Tax Rate in North Carolina.

Pin By Xinedonovan On 2021 Tax Receipts Fontana Village Fontana 10 Things

B Three states levy mandatory statewide local add-on sales taxes.

. Download Table Tax rates of selected food items from publication. 92 out of the 100 counties in North Carolina collect a local surtax of 2. North Carolina has a 475 statewide sales tax rate but also has 460 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax.

The North Carolina Exempt and Taxable sales tax book for manufacturers educates on the states sales tax exemptions exclusions from tax and taxable purchases of the business starting with advertising and ending with warranty repairs. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. Sales tax in North Carolina is between 475 and 75 as of Oct 2013.

Many businesses that did not qualify in Phase 1 are now eligible to apply in Phase 2. Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. Ohio grocery items are exempt if sold for off-premises consumption.

Please refer to the north carolina website for more sales taxes information. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. This document serves as notice that effective January 1 2009 there is a new exemption from State sales and use tax for bakery items sold without eating utensils by an artisan bakery.

We are passionate. Sales and Use Tax. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic.

Explore Our Guides for Specialized North Carolina Tax Help. Retail sales retail sales of tangible personal property are subject to the 475 state sales or use tax. The 475 general sales rate tax plus local tax is charged on non-qualifying food which includes prepared foods and beverages in restaurants dietary supplements food sold through vending machines bakery items sold with eating utensils soft drinks and candy.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. North Carolina has recent rate changes Fri Jan 01 2021. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

North Carolina Sales Tax Training for Manufacturers. Select the North Carolina city from the list of popular cities below to. Only 12 items left.

With local taxes the total sales tax rate is between 6750 and 7500. In sum north carolina has applied a sales tax on food since 1961. Sales of these items will be subject to the 2 local rate of.

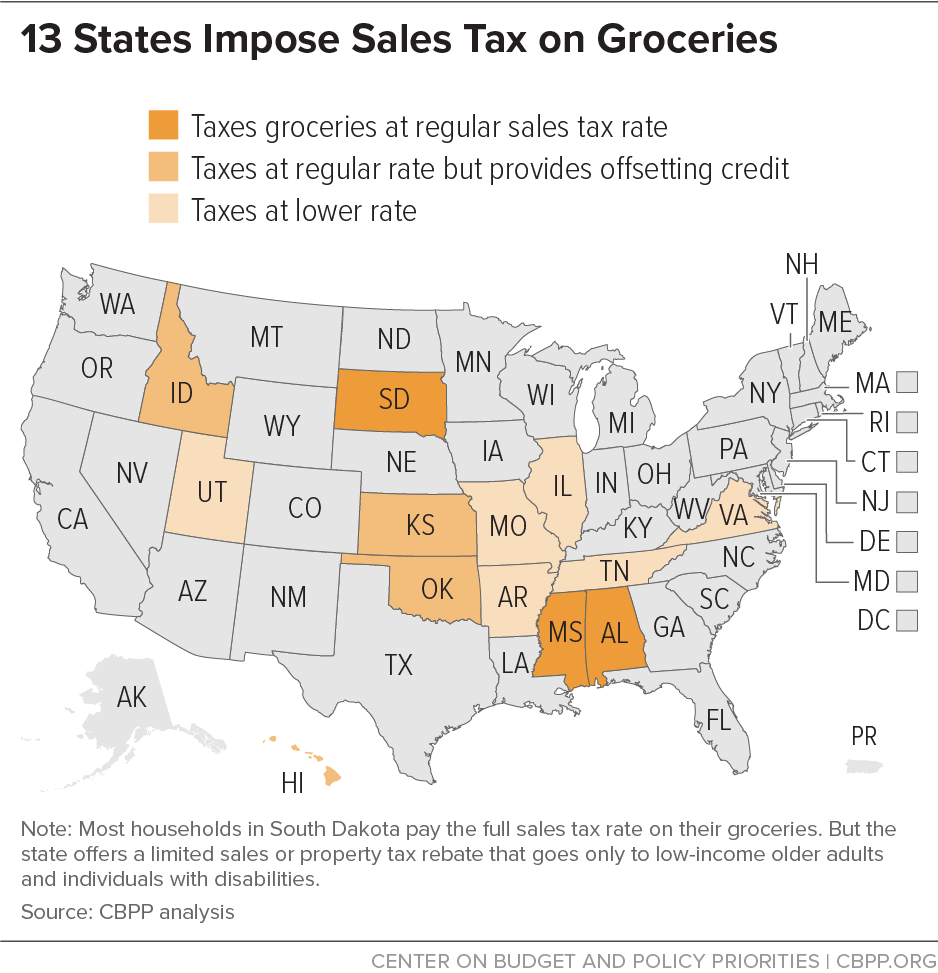

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. North Dakota grocery items are tax exempt.

For example flour sugar bread milk eggs fruits vegetables and similar groceries food products are not subject to Texas sales and use tax. Who Should Register for Sales and Use Tax. 35 rows Sales and Use Tax Rates Effective October 1 2020.

A customer buys a toothbrush a bag of candy and a loaf of bread. To learn more see a full list of taxable and tax-exempt items in North Carolina. These categories may have some further qualifications before the special rate applies such as a price cap on clothing items.

The state sales tax rate in North Carolina is 4750. Form E-502R 2 Food Sales and Use Tax Chart NCDOR. Grocery stores and convenience stores not only sell food products they also sell a wide variety of other items and services some of them taxable and others nontaxable.

Business Recovery Grant Program Phase 2 of the Business Recovery Grant program is now open. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical. The transit and other local rates do not apply to qualifying food.

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on qualifying food which includes groceries and bakery items sold without eating utensils. Measuring industrial interdependence to find an effective development strategy for.

We include these in their state sales. For Further Assistance Use Our Directory to Connect with a North Carolina CPA in Your Area. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Food Non-Qualifying Food and Prepaid Meal Plans. Overview of Sales and Use Taxes.

Lease or Rental of Tangible Personal Property. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. What transactions are generally subject to sales tax in North Carolina.

Apply now through June 1 2022. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Carolina local counties cities and special taxation districts.

Menu Skip to content. California 1 Utah 125 and Virginia 1. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

Tax Free Week Starts Today For Hurricane Supplies Be Prepared Now Instead Of Waiting Until A Storm Is Hea Plastic Drop Cloth Hurricane Supplies Disaster Prep

20 Nc Counties See Fha Loan Limit Changes Copper Prices Price Reduction Retail Solutions

Is Food Taxable In North Carolina Taxjar

Pin By Alexa On Life Hacks Poster Movie Posters Life Hacks

North Carolina Sales Tax Rates By City County 2022

North Carolina Sales Tax Small Business Guide Truic

Food Lion Weekly Ad Flyer Aug 18 Aug 24 2021 Jcdavila Com My Weekly Ad Journals In Us United States Food Lion Weekly Ads Grocery Sales

Understanding Sales Tax With Printify Printify Sales Tax Printify Understanding

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Is Food Taxable In North Carolina Taxjar

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Budget Food Shopping Harris Teeter

Sales Tax On Grocery Items Taxjar

How To Use A North Carolina Resale Certificate Certificate Etsy Business Sell Items

Is Food Taxable In North Carolina Taxjar

Tampon Tax Tampon Tax Pink Tax Tampons

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards